Didn’t find what you’re looking for? Let us know your needs, and we’ll tailor a solution just for you.

A Robust General Insurance Planning Software

- Combined Ratio

- Assets Under Management (AUM)

- Effective Tariff

- Business Mix

- Realized return and Investment Leverage

REPLAN for General Insurance Business Planning

The only planning solution you need for operational and financial planning for your insurance business. Replan comes with intuitive UX and a robust structure for easy adaptation and business success.

REPLAN - Robust Airline Business Planning Solution

Combined Ratio

Measures profitability by comparing underwriting losses and expenses to premiums earned. A ratio below 100% indicates underwriting profit, above 100% signifies a loss. It analyzes expense drivers and claim trends to identify cost-saving opportunities and improve profitability.

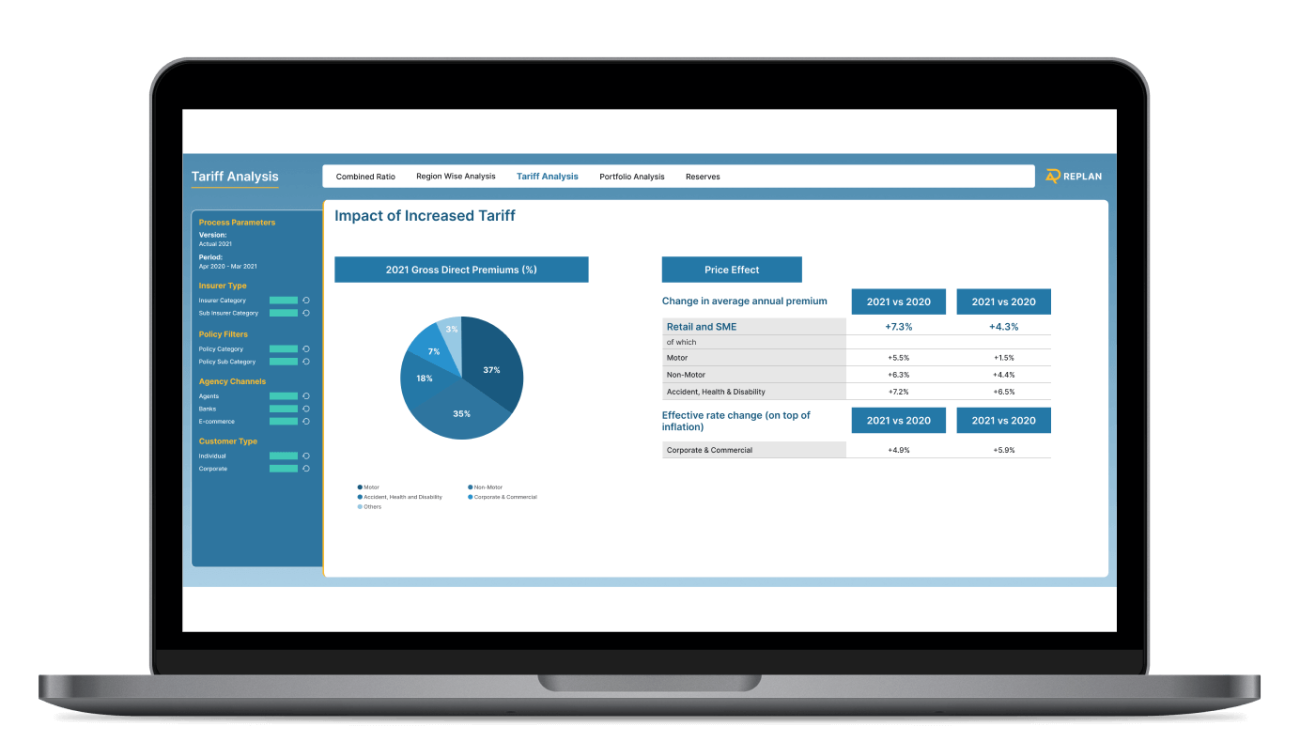

Assets Under Management (AUM)

Tracks the total value of the company’s invested assets (premiums collected). The business monitors AUM growth to assess premium collection and project future investment income. AUM is also considered when setting risk tolerance levels for investment decisions.

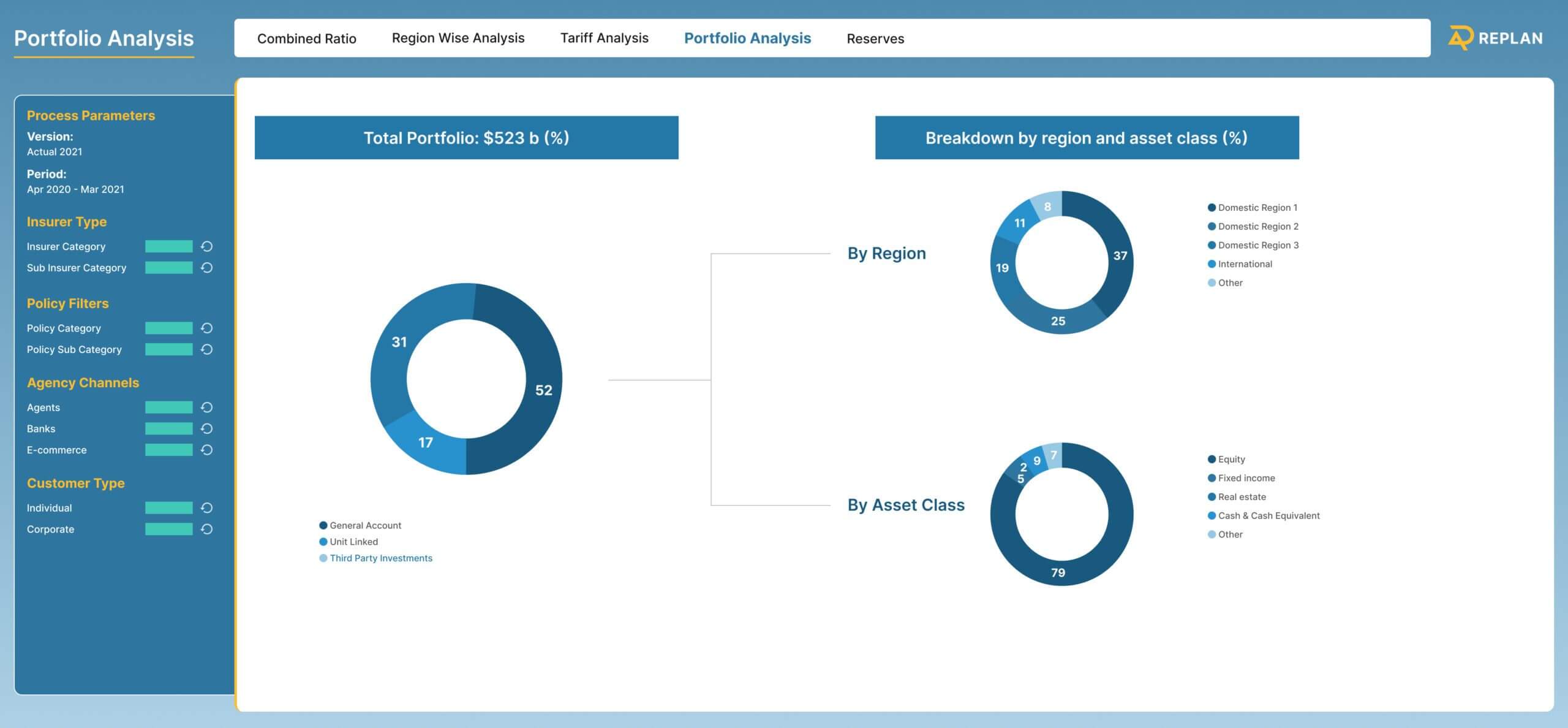

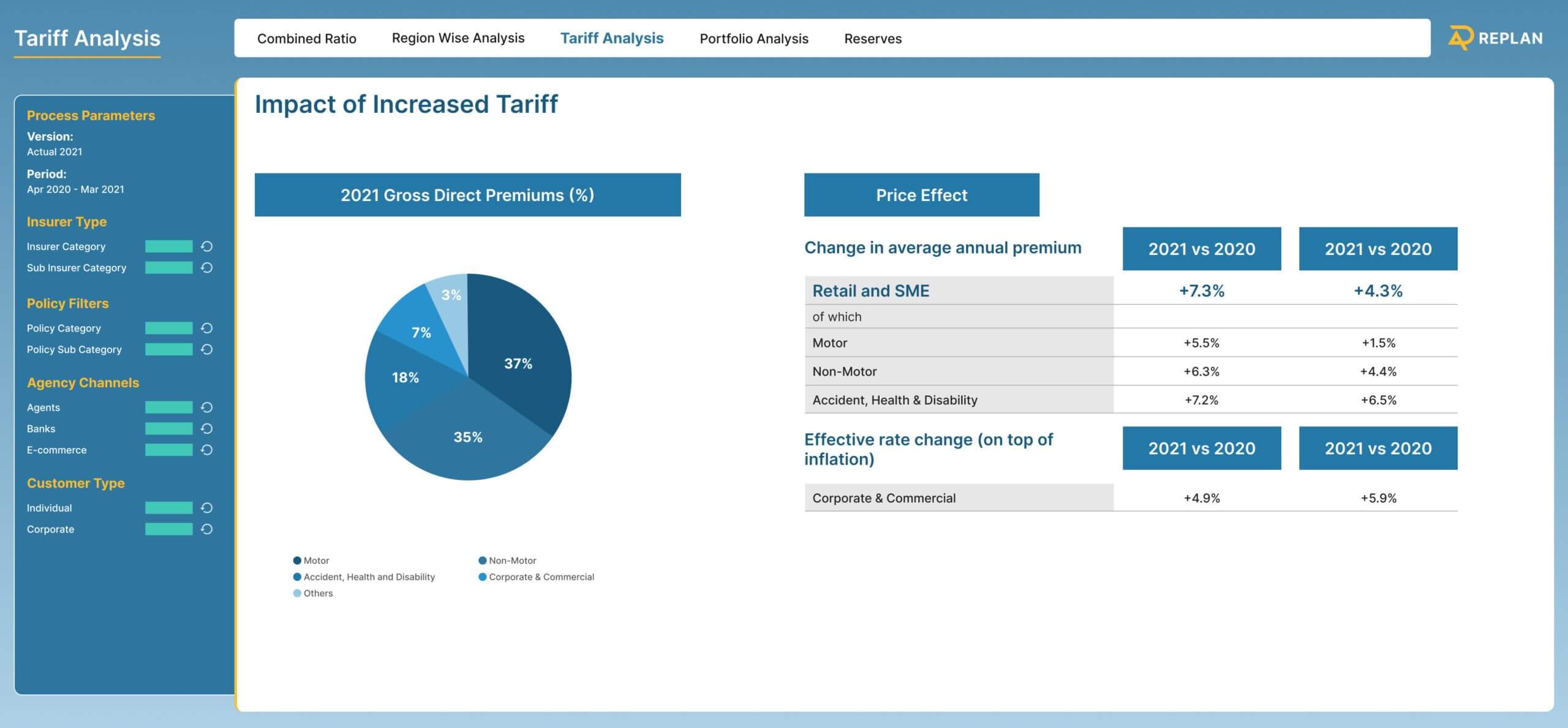

Effective Tariff

Represents the average premium rate actually charged to customers, compared to the base or published rate. It reflects how effective tariffs affect profitability alongside risk profiles. The business may identify opportunities to adjust pricing strategies for different customer segments or risk categories.

Financial Planning For Aircraft Related Fixed Costs

Refers to the distribution of premiums across different insurance lines (e.g., auto, property, health). The business can evaluate the profitability and risk associated with each business line within the mix. This helps optimize product offerings, identify areas for expansion, and manage overall portfolio risk.

Realized return and Investment Leverage

Realised return directly affects a general insurer’s profitability. Strong realised returns can contribute to underwriting profitability by generating additional income and vice-versa. Investment leverage refers to the use of debt financing to amplify investment returns. In general insurance companies, this is less common than in other industries due to the need for solvency and regulatory constraints.

REPLAN - General Insurance Business Planning with Ease

Strategic Planning

Strategic Thinking

Long Range Planning

Initiatives Short Planning

Capital Allocation

Operations Planning

Spend NEA

Interest Income

New Account Planning

HR Planning

Incentive Income/Other Income

IT, MKTG, and Other Staff Functions Planning

Advanced Analytics

Visual Data Discovery

Analytics

Financial Planning

Multi-Currency Management

Intercompany Treatment

Consolidation

Driver Based Output

Financial Statement Schemes

Working Capital Planning

Reporting

Management Reporting

Statutory Reporting

Dashboarding

Self Service

Financial Reporting

Disclosures/External Reporting

Regulatory Reporting

Office Reporting

Some Features of General Insurance ERP Software

Our Solution Helps retailers stay ahead of demand and deliver excellence.

Gross Written Premium (GWP)

Gross Written Premium (GWP) reflects a firm's risk underwriting capability and income generation strength. Precise calculation of GWP enables insurers to gauge performance relative to competitors, optimize pricing, and maintain solid financial standing. With close examination, companies can make data-driven choices, enhance underwriting processes, and much more.

Reinsurance

Reinsurance transfers part of the risk to other insurers, lowering the financial impact of big claims. This strategy ensures an insurer's stability, affects revenue planning, and reduces exposure to major losses. Reinsurers enable primary insurers to efficiently use capital and underwrite more business by minimizing the effect of catastrophic events on their finances.

Net Written Premium (NWP)

Net Written Premium (NWP) is a vital financial metric that signifies an insurer's actual revenue post-deductions of reinsurance costs and charges. Accurate calculation of NWP helps assess profitability, gauge risk management efficiency, and inform decision-making regarding resource allocation, pricing optimization, and strategic alignment.

Commission Charges

Brokers and agents, who distribute and sell insurance products, earn commissions that need accurate assessment and management for effective financial planning. Balancing these expenses is crucial to maintaining profitability and achieving strategic goals, as well as enhancing customer acquisition and staying competitive in the evolving insurance industry.

Net Earned Premium (NEP)

Net Earned Premium (NEP) is the share of premiums earned by insurers after considering reinsurance and adjustments. It reflects actual revenue from underwriting. Accurate NEP calculation helps evaluate underwriting strategy effectiveness, set prices, manage risks, and measure returns. Monitoring NEP is crucial for insurers to adapt to market changes, address new risks, and ensure financial stability.

Asset Liability Management (ALM)

General insurers collect premiums upfront but pay out claims over time, often years later. This creates a mismatch between cash inflows and outflows. Market fluctuations can further complicate this by impacting investment returns. ALM helps general insurers manage this risk by strategically aligning their assets with their liabilities. It ensures the company has sufficient funds to meet its obligations while optimizing investment returns.

Key Benefits of Replan

The current business landscape is full of complexities and obstacles that hinder growth. Therefore it’s crucial to address these challenges head-on to ensure business success.

- Reduce Time of Implementation

- Best Practices will be part of the Solution

- Fully Configurable as per Customer requirement

- Fully Integrated with Core FP&A Platform

- Pre-configured Scalable solution

Blog & News Update

Why AUM Matters and How It Reflects Financial Health

When you look at how well a fund or investment firm is doing, one key number stands out Assets Under

October 31, 2025

Understanding Embedded Value Reports in Life Insurance Companies

Life insurance companies operate in a unique way compared to other financial institutions. Their business revolves around long-term commitments, policyholder

October 31, 2025

Insurance ERP Software to Make Your Business Smarter

REPLAN offers a comprehensive enterprise planning solution for general insurance companies looking to streamline their financial planning and underwriting processes. With interactive features, REPLAN provides valuable insights to help companies make data-driven decisions and drive business growth.

Additionally, our software includes tools for managing gross written premium, reinsurance, net written premium, etc to provide companies with a complete picture of their financial health.

By implementing REPLAN, general insurance companies can improve their financial performance, enhance their risk management strategies, and stay ahead of the competition.