Didn’t find what you’re looking for? Let us know your needs, and we’ll tailor a solution just for you.

Simplifying Legal Consolidation & Reporting

- Diverse Business Combinations.

- Multi-Currency Translations and Reporting.

- Intercompany Eliminations.

- Non-controlling Interests.

- Standalone and Consolidated Financial Reporting Statements.

REPLAN - A Complete Demand And Supply Chain Planning Solutions

01

Intercompany Reconciliation

Ensure accurate, compliant reconciliation across entities, streamlining multi-entity financial close for clarity, efficiency, and audit readiness

02

Financial Consolidation

Deliver accurate, compliant financial consolidation, empowering organizations to confidently close books and drive strategic decisions with clarity.

03

Management Reporting

Gain control over performance with our timely, accurate management reporting, translating data into actionable business insight.

04

Statutory Reporting

Effortlessly meet legal compliance with our statutory reporting services, ensuring accurate, regulation-aligned reporting across jurisdictions.

REPLAN for Legal Consolidation & Reporting

REPLAN is a legal consolidation and reporting tool that streamlines financial management for businesses.

REPLAN - A Complete Demand And Supply Chain Planning Solutions

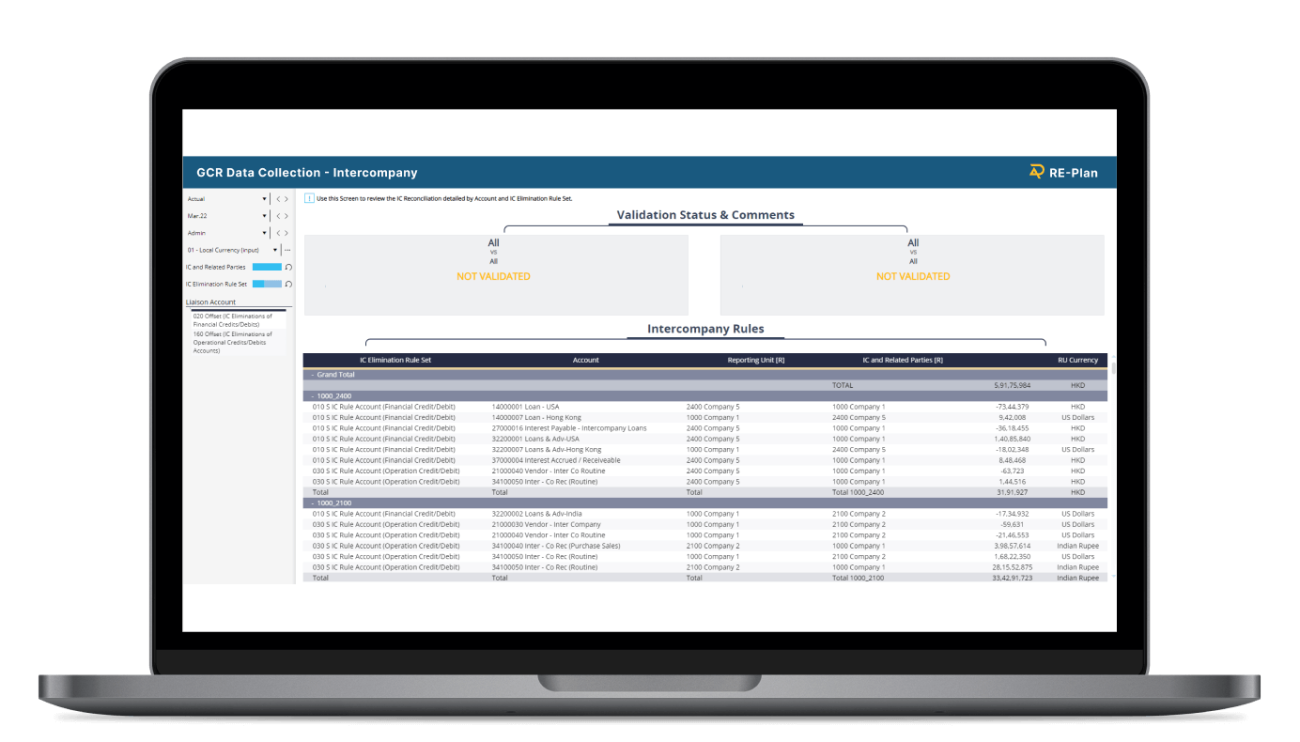

Diverse Business Combinations

You can involve the integration of two or more entities to form a single economic entity including mergers, acquisitions, joint ventures, and strategic alliances are common forms of business combinations. It can diversify business combinations using applicable accounting standards, considering factors like goodwill, fair value assessments, and potential adjustments to assets and liabilities.

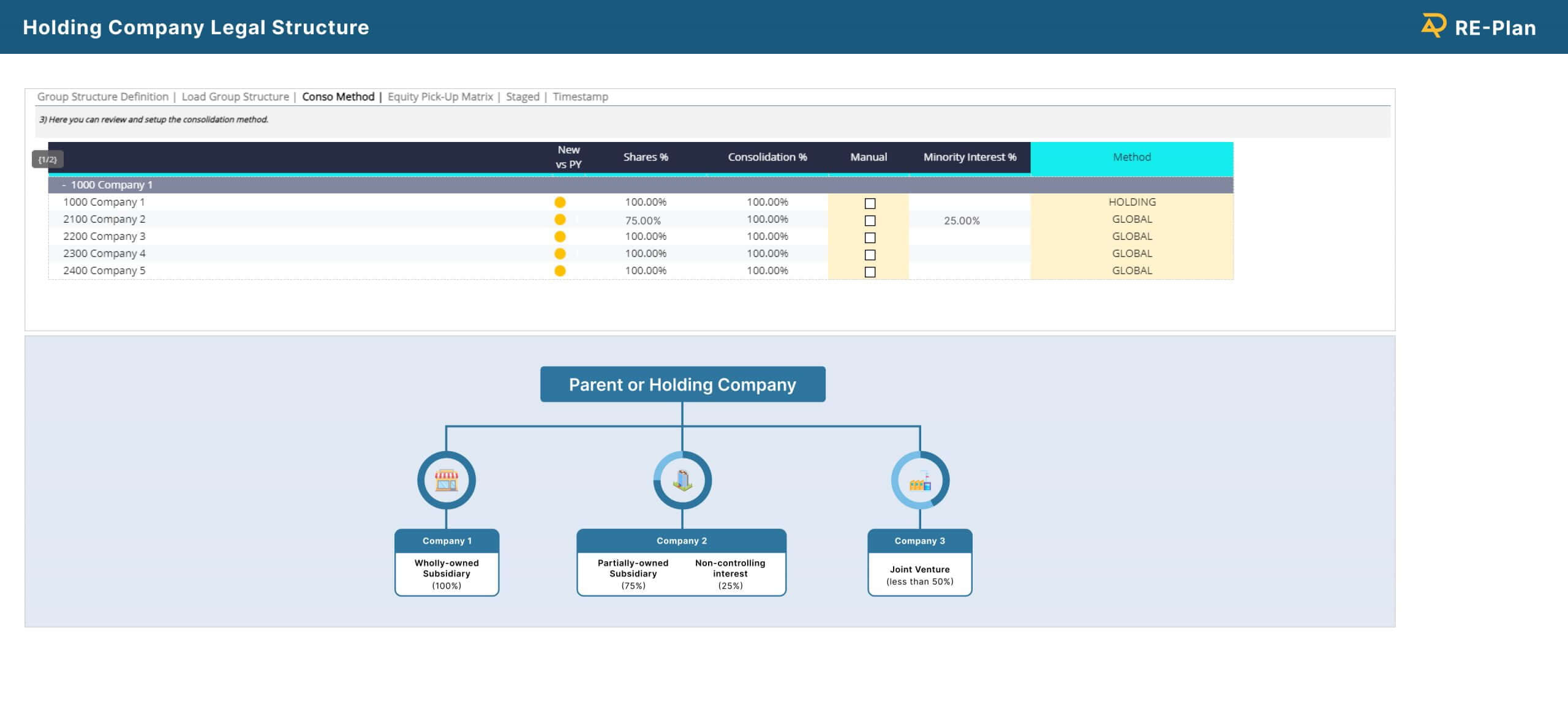

Multi-Currency Translations

You can translate financial statements of foreign entities to the reporting currency using appropriate exchange rates. It considers functional currency, historical rates for balance sheet items, and average rates for income statement items.

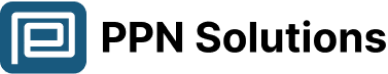

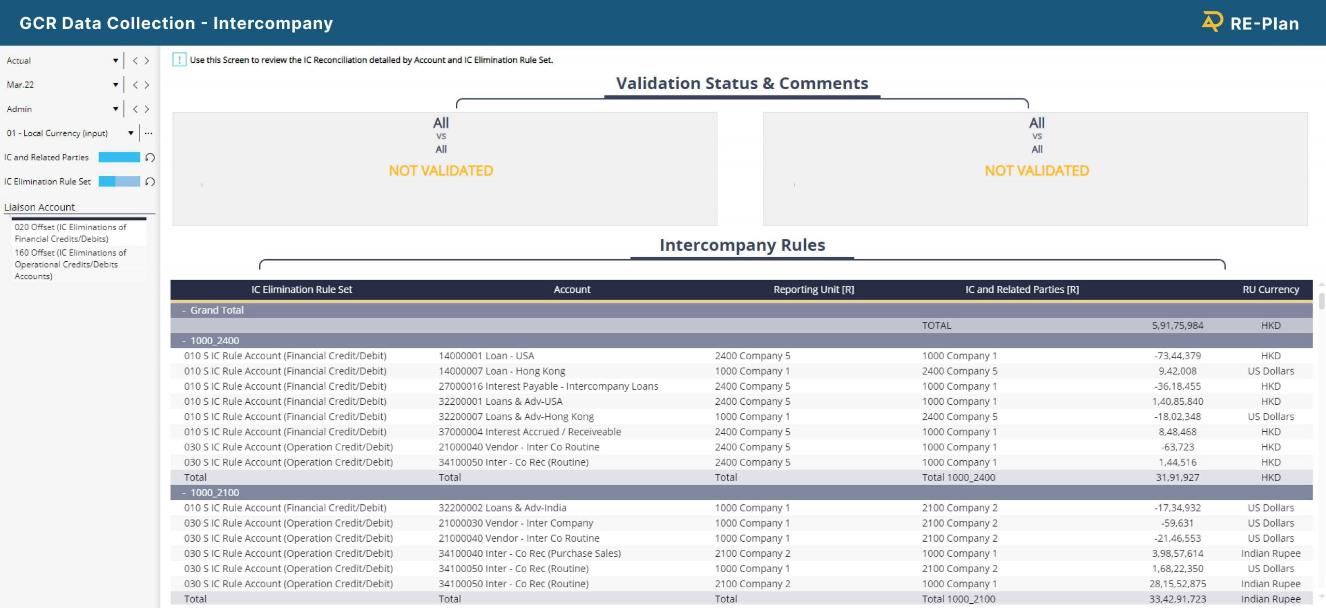

Intercompany Eliminations

REPLAN identifies and offsets double-counting transactions between group entities and offers accurate financial statements. Our system identifies and offsets reciprocal transactions, ensuring that only genuine external transactions affect your bottom line. You can eliminate intercompany revenue and expenses, intercompany loans, and unrealized profits with ease.

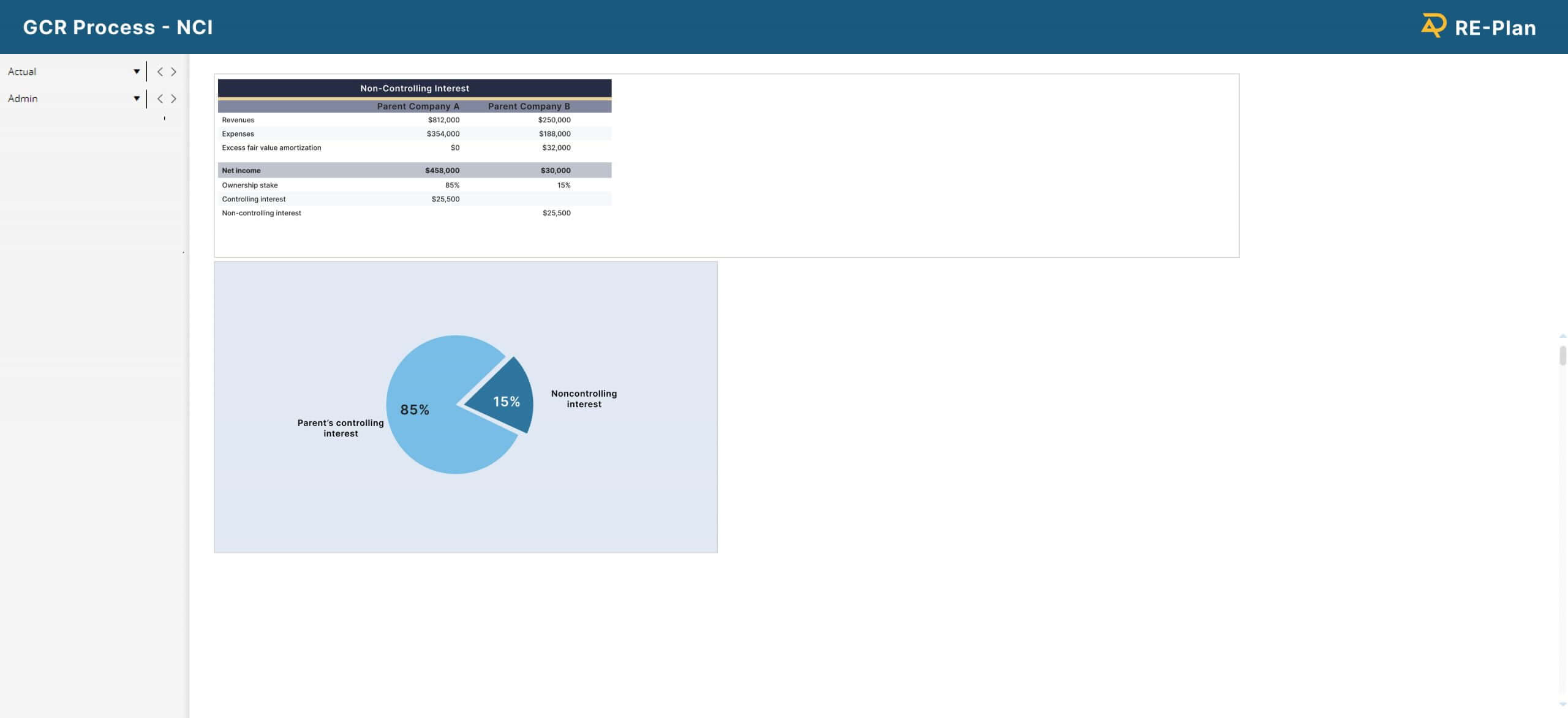

Non-Controlling Interests

Non-controlling interests (NCI) represent the portion of equity in a subsidiary not owned by the parent company. NCI is reported separately in the consolidated financial statements. The share of profits or losses attributable to NCI is presented in the consolidated income statement.

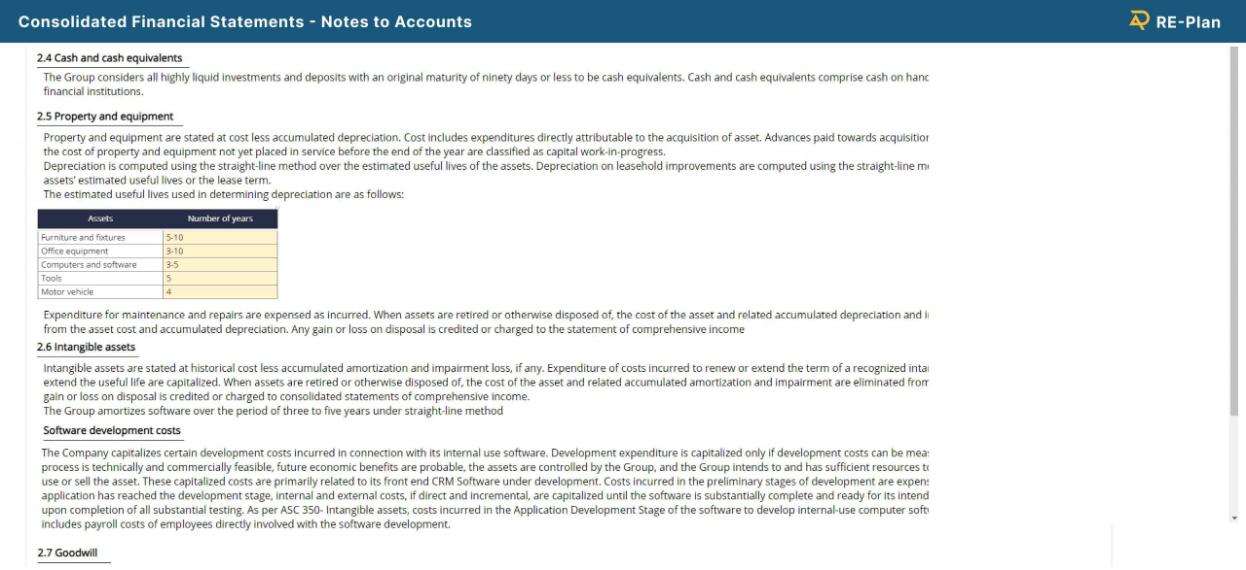

Consolidated Financial Statements

Consolidated financial statements are presented using the financial position, performance, and cash flows of a group of companies as if they were a single entity. It includes the parent company and its subsidiaries, with adjustments for intercompany transactions and non-controlling interests. It provides a comprehensive view of the financial health and performance of the entire group.

Salient Features of Supply Chain Management Solution

Integration of Diverse Entities

Set clear objectives and strategies for the year ahead and align your entire organization around a single, cohesive plan to drive growth and success.

Multi-Currency Considerations

Simplify complex legal and management structures with our consolidation solution, streamlining reporting and improving transparency across your organization.

Intercompany Eliminations

Ensure compliance and strategic alignment by requiring B&M head and brand head approvals before PO creation, while empowering users to efficiently select styles and sizes, seamlessly initiating the purchase process.

Recognition of Non-Controlling Interests

Effortlessly meet statutory reporting requirements with our comprehensive solution, ensuring compliance with relevant laws and regulations.

Compliance & Reporting

Improve forecasting and planning accuracy by leveraging real-time data and advanced analytics to inform decision-making.

Holistic Financial Statements

Maximize sales and profitability through data-driven assortment, pricing, and inventory strategies.

Key Benefits of Replan

The current business landscape is full of complexities and obstacles that hinder growth. Therefore it’s crucial to address these challenges head-on to ensure business success.

- Reduce Time of Implementation

- Best Practices will be part of the Solution

- Fully Configurable as per Customer requirement

- Fully Integrated with Core FP&A Platform

- Pre-configured Scalable solution

Blog & News Update

Why Legal Entity Consolidation Is Important for Financial Accuracy

Companies that operate through multiple subsidiaries, divisions, or international branches often face a challenging task: making sense of financial data

December 9, 2025

Understanding Legal Consolidation in SAP BPC: A Complete Guide

Understanding Legal Consolidation in SAP BPC: A Complete Guide For organizations managing multiple subsidiaries, consolidating financial data accurately is essential

December 9, 2025

Understanding Consolidation Legal Issues in Financial Reporting

Financial reporting is most valuable when it provides a clear, accurate picture of an organization’s true financial position. For companies

December 9, 2025

Streamline Operations & Maximize Profits with REPLAN

Effective legal consolidation is essential for any corporate group, as it enables the organization to present its financial performance accurately. Our solution helps streamline the process of legal consolidation by automating the elimination of intercompany transactions, calculating the netting of receivables and payables, and generating detailed reports. With our tool, you can ensure that your financial statements reflect the true financial position of your company, comply with accounting standards, and provide stakeholders with transparent information.

Timely and accurate reporting is critical for informed decision-making within an organization. Our solution provides comprehensive reporting capabilities, including real-time data integration, and drill-down analytics. You can generate reports on demand to ensure that you always have access to up-to-date information.